KELLOGG, Idaho and VANCOUVER, British Columbia, Oct. 28, 2024 (GLOBE NEWSWIRE) — Bunker Hill Mining Corp. (“Bunker Hill” or the “Company”) (TSXV:BNKR | OTCQX:BHLL) is pleased to announce that it has received a non-binding Letter of Interest (“LOI”) from the Export-Import Bank of the United States (“EXIM”) for a debt funding package of up to $150M with a loan term of up to 15 years.

The funding will enable the Company to expedite the development of the 2500tpd Bunker 2.0 expansion project (the “Expansion Project”) coincident with restarting the mine and strengthening the balance sheet.

”We are thrilled to announce this first step in a potential partnership with EXIM to rapidly expand Bunker Hill’s contribution to US domestic production of critical zinc and silver,” said President and CEO, Sam Ash. “In the face of competition from China, Bunker Hill is proud to play its part in strengthening the US metals supply chain and creating new US mining jobs within the disadvantaged Shoshone County of Northern Idaho.”

Figure 1 – Bunker Hill Staff and Contractors standing inside the 1800tpd processing plant in Kellogg, Idaho

BUNKER HILL 2.0 EXPANSION PROJECT

Coincident with the planned restart of the operations at 1800tpd in the first half of next year, the company intends to conduct extensive drilling from the underground and surface of previously identified exploration targets. This will be complemented by detailed engineering studies designed to support a ramp-up to 2500tpd operations under the previously announced Bunker Hill 2.0 Concept.

The first step on this path will be to issue an updated resource and reserve report in Q1|25, followed by further exploration conducted underground and at the surface. As key milestones are completed, the Company will update the market and its strategic partner on the evolution of this concept and its supporting resources.

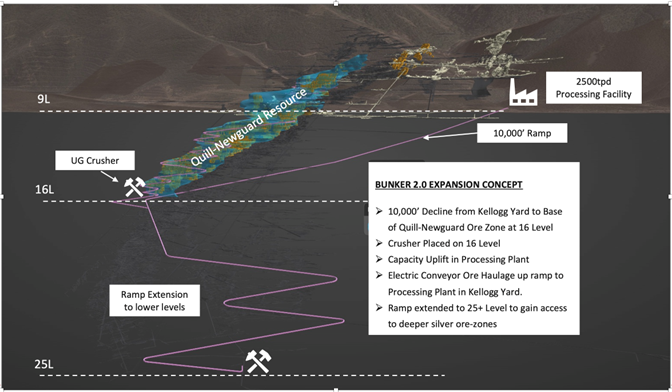

Figure 2 – Bunker Hill 2.0 Expansion Concept

The Bunker Hill 2.0 expansion concept is designed to significantly increase the rate and efficiency of the mining and processing of the Quill-Newgard ore zones and subsequently enable access to the deeper, higher-grade silver galena veins being mined from the lower levels of the mine when the mine closed in 1981.

The LOI from EXIM does not represent a financing commitment and is a preliminary step in the formal EXIM application process. The debt financing is subject to the satisfactory completion of due diligence, the negotiation and settlement of final terms, and the negotiation of definitive documentation. There can be no assurance that the debt financing will be completed on the terms described above. The Company will update the market upon reaching a definitive agreement with EXIM for funding support.

The Company expects to submit a formal application to EXIM by the end of 2024.

ZINC, SILVER AND THE US CRITICAL METALS LIST

Zinc has been included in the US Critical Metals list since 2022, while silver is being reviewed now for the 2025 list by the United States Geological Survey (“USGS”). Both are metal inputs to the energy transition, the ongoing upgrade to critical national infrastructure and to domestic re-industrialization. Zinc for its ability to galvanize steel, and silver for its reflective and electrical and thermal conductive properties.

The 2022 list was created based on directives from the Energy Act of 2020, which indicates that at least every three years, the Department of the Interior must review and update the list of critical minerals, update the methodology used to identify potential critical minerals, take interagency feedback and public comment through the Federal Register, and ultimately finalize the list of critical minerals.

The Energy Act of 2020 defines a “critical mineral” as a non-fuel mineral or mineral material essential to the economic or national security of the U.S. and with a supply chain vulnerable to disruption. Critical minerals are also characterized as serving a necessary function in manufacturing a product, the absence of which would have significant consequences for the economy or national security.

ABOUT THE EXPORT-IMPORT BANK OF THE UNITED STATES

EXIM is the official export credit agency of the United States of America. EXIM is an independent Executive Branch agency with a mission of supporting American jobs by facilitating the export of US goods and services.

As published in its 2023 Annual Report, EXIM currently has exposure to US$1,476.7B in lending across 148 countries worldwide. The default rate across the portfolio is 0.98%, reflecting the high standards of credit required to obtain EXIM financing. Furthermore, EXIM’s charter requires that it supplement and encourage, not displace, private capital.

The EXIM Make More in America Initiative (“MMIA”) was developed in response to President of the United States Executive Order 14017 on American Supply Chains and provides U.S. manufacturers new access to capital to fill critical supply chain gaps, and was approved by EXIM’s Board of Directors in April 2022. MMIA’s objective is to unlock financing for U.S. manufacturing and close critical supply chain gaps, especially in sectors critical to national security. Under MMIA, EXIM can make the agency’s existing medium- and long-term loans, loan guarantees, and insurance programs available to export-oriented domestic projects such as Bunker Hill.

The China and Transformational Exports Program (“CTEP”) was established through a December 2019 Congressional reauthorization of EXIM’s charter. Under CTEP’s mandate, EXIM is authorized to help US exporters facing competition from China and to ensure that the US continues to lead in crucial strategic areas critical to national security, including renewable energy, storage and efficiency. CTEP supports the extension of EXIM loans, guarantees and insurance at rates and on terms and other conditions, to the extent practicable, that are fully competitive with rates, terms and other conditions established by China.

ABOUT BUNKER HILL MINING CORP.

Under Idaho-based leadership, Bunker Hill intends to restart and develop the Bunker Hill Mine sustainably to consolidate and optimize several mining assets into a high-value portfolio of operations centered initially in North America. Information about the Company is available on its website, www.bunkerhillmining.com, or within the SEDAR+ and EDGAR databases.

On behalf of Bunker Hill Mining Corp.

Sam Ash

President and Chief Executive Officer

For additional information, please contact:

Brenda Dayton

Vice President, Investor Relations

T: 604.417.7952

E: [email protected]

Cautionary Statements

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this news release.

Certain statements in this news release are forward-looking and involve a number of risks and uncertainties. Such forward-looking statements are within the meaning of that term in Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, as well as within the meaning of the phrase ‘forward-looking information’ in the Canadian Securities Administrators’ National Instrument 51-102 – Continuous Disclosure Obligations (collectively, “forward-looking statements”). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or variations of such words and phrases.

Forward-looking statements in this news release include, but are not limited to, statements regarding: the Company’s objectives, goals or future plans, including the restart and development of the Bunker Hill Mine; the achievement of future short-term, medium-term and long-term operational strategies; the Silver Loan; the Company receiving TSX-V approval for the Silver Loan and the issuance of the Warrants and the Warrant Shares; and the timing and advancement of additional tranches of the Silver Loan and additional Warrants. Factors that could cause actual results to differ materially from such forward-looking statements include, but are not limited to, those risks and uncertainties identified in public filings made by Bunker Hill with the U.S. Securities and Exchange Commission (the “SEC”) and with applicable Canadian securities regulatory authorities, and the following: the Company not receiving the approval of the TSX-V for the issuance of the Warrants and the Warrant Shares; the Company’s inability to raise additional capital for project activities, including through equity financings, concentrate offtake financings or otherwise; the fluctuating price of commodities; capital market conditions; restrictions on labor and its effects on international travel and supply chains; failure to identify mineral resources; failure to convert estimated mineral resources to reserves; the preliminary nature of metallurgical test results; the Company’s ability to restart and develop the Bunker Hill Mine and the risks of not basing a production decision on a feasibility study of mineral reserves demonstrating economic and technical viability, resulting in increased uncertainty due to multiple technical and economic risks of failure which are associated with this production decision including, among others, areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves, more detailed metallurgy and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit, with no guarantee that production will begin as anticipated or at all or that anticipated production costs will be achieved; failure to commence production would have a material adverse impact on the Company’s ability to generate revenue and cash flow to fund operations; failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; political risks; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; the inability of the Company to budget and manage its liquidity in light of the failure to obtain additional financing, including the ability of the Company to complete the payments pursuant to the terms of the agreement to acquire the Bunker Hill Mine complex; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the development of projects; and capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry. Although the Company believes that the assumptions and factors used in preparing the forward-looking statements in this news release are reasonable, undue reliance should not be placed on such statements or information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all, including as to whether or when the Company will achieve its project finance initiatives, or as to the actual size or terms of those financing initiatives. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Readers are cautioned that the foregoing risks and uncertainties are not exhaustive. Additional information on these and other risk factors that could affect the Company’s operations or financial results are included in the Company’s annual report and may be accessed through the SEDAR+ website (www.sedarplus.ca) or through EDGAR on the SEC website (www.sec.gov).

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4e50e403-5dda-4fe3-accd-a3c1115a0460

https://www.globenewswire.com/NewsRoom/AttachmentNg/6d9e7bfb-d0ba-450e-9db1-92b3c768a344